Kit, System And Associated Method And Service For Providing A Platform To Prevent Fraudulent Financial Transactions

Patent No. US10937018 (titled "Kit, System And Associated Method And Service For Providing A Platform To Prevent Fraudulent Financial Transactions") was filed by Paygeo Llc on Sep 1, 2020.

What is this patent about?

’018 is related to the field of financial transactions, specifically systems and methods for enabling the exchange of cash, digital currency, and commodities in a mobile telecommunications environment. The background acknowledges the increasing use of mobile devices for financial transactions but notes the persistence of cash as a barrier to a fully electronic wallet. Existing solutions for electronic payments don't fully eliminate the need for cash, and ATM machines often don't cater to non-bank account holders.

The underlying idea behind ’018 is to provide a platform that allows users to conduct a wide range of financial transactions, including transferring, receiving, and exchanging cash, digital currency, and commodities, all within a mobile environment. This involves creating a digital wallet that can replace a physical wallet, enabling users to perform transactions with each other, with merchants, and with ATMs, even without traditional bank accounts. A key aspect is the integration of various payment methods and security features into a single mobile application.

The claims of ’018 focus on a system comprising memory storing program code associated with a service provided by a third-party entity to a plurality of members who register with the service. The system includes multiple communication interfaces to interact with credit card companies, financial institutions, and the third-party entity itself. The claims cover the process of user login, registration of payment sources (including credit cards and bank accounts), selection of a payment function, identification of a payee, selection of a payment source, input of a payment amount, and the electronic transfer of funds using the appropriate communication interface. Finally, the claims cover generating a notification to the payee.

In practice, the invention works by providing a mobile application that acts as a central hub for all financial transactions. Users can register their various payment methods, such as credit cards, bank accounts, and a dedicated account within the platform. When a user wants to make a payment, they select the payee, the payment amount, and the desired payment method. The system then uses the appropriate communication interface to initiate the transaction with the relevant financial institution or payment processor. The system also supports features like scanning barcodes for payments, depositing or withdrawing cash at ATMs using generated codes, and exchanging funds in different currencies.

’018 differentiates itself from prior approaches by offering a comprehensive mobile platform that integrates various financial services and payment methods into a single application. Unlike existing solutions that may focus on specific types of electronic payments or require traditional bank accounts, this invention aims to create a complete digital wallet that can replace the need for physical cash and cards. The system's ability to interact with ATMs, support commodity exchanges, and provide advanced security features further distinguishes it from conventional mobile payment systems.

How does this patent fit in bigger picture?

Technical landscape at the time

In the early 2010s when ’018 was filed, mobile payment systems were gaining traction, at a time when NFC and QR code-based transactions were typically implemented using dedicated hardware or software applications on smartphones. Systems commonly relied on centralized servers for transaction processing and user authentication, rather than distributed ledger technologies. Hardware or software constraints made secure storage of financial credentials on mobile devices non-trivial.

Novelty and Inventive Step

The examiner allowed the claims because the applicant addressed both a double patenting rejection and a rejection under 35 U.S.C. 101. The double patenting rejection was withdrawn due to the filing of a terminal disclaimer. The 35 U.S.C. 101 rejection was overcome because the claims recited specific additional limitations, including memory storing program code associated with a service provided by a third-party entity to a plurality of members, and various communication interfaces and code configurations that, when viewed as a whole, were significantly more than providing a platform that enables members to transfer, receive, or otherwise exchange cash in various international denominations and commodities. The examiner also stated that the combination of cited prior art references did not teach all the claimed limitations.

Claims

This patent contains 14 claims, with independent claims 1 and 8. The independent claims focus on a system and method for facilitating payments between members of a third-party service using various payment sources. The dependent claims generally elaborate on specific implementations and features of the system and method described in the independent claims.

Key Claim Terms New

Definitions of key terms used in the patent claims.

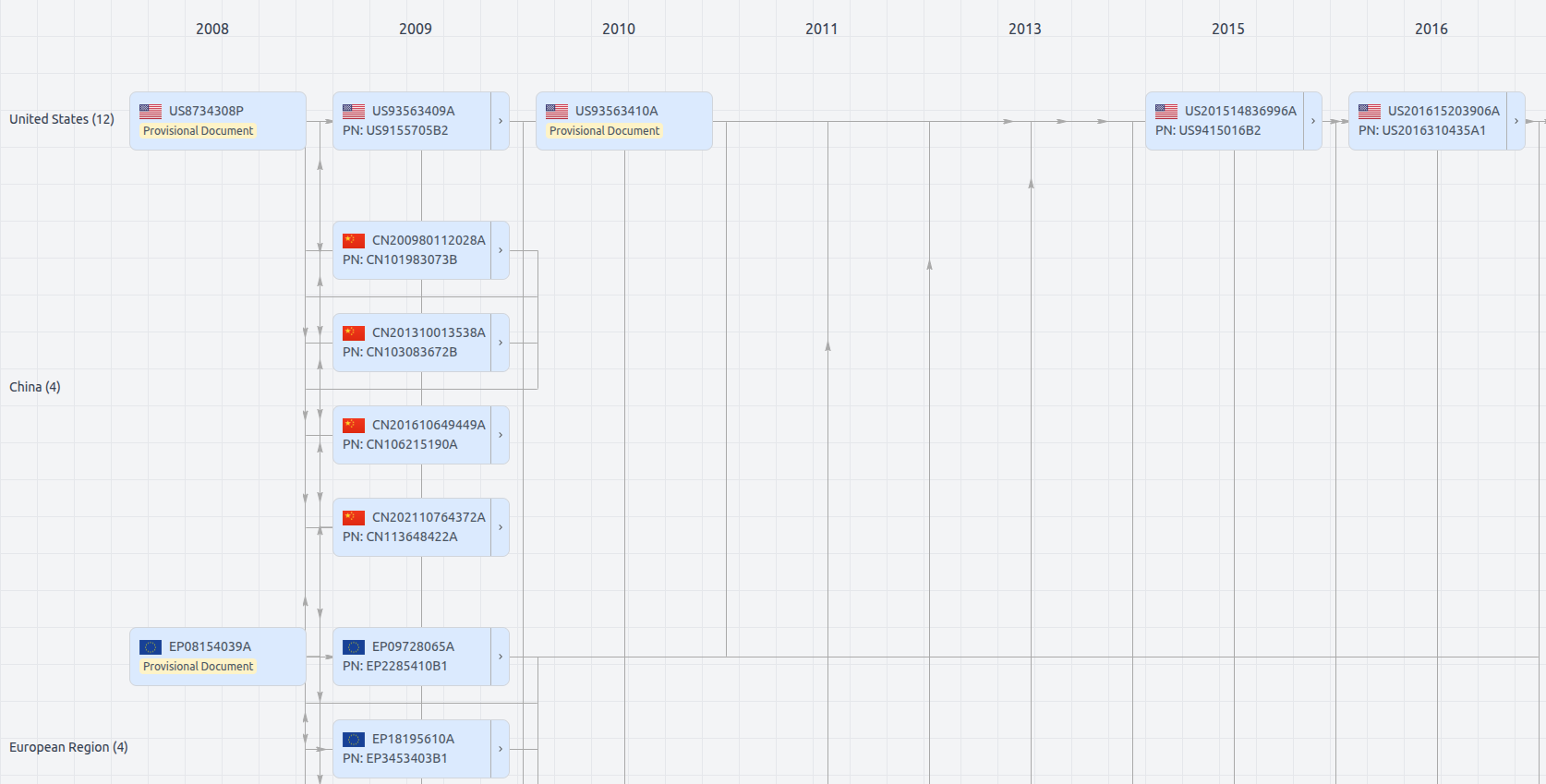

Patent Family

File Wrapper

The dossier documents provide a comprehensive record of the patent's prosecution history - including filings, correspondence, and decisions made by patent offices - and are crucial for understanding the patent's legal journey and any challenges it may have faced during examination.

Date

Description

Get instant alerts for new documents

US10937018

- Application Number

- US17009551

- Filing Date

- Sep 1, 2020

- Status

- Granted

- Expiry Date

- Jul 18, 2031

- External Links

- Slate, USPTO, Google Patents