System And Method For Automated Optimization Of Financial Assets

Patent No. US11315090 (titled "System And Method For Automated Optimization Of Financial Assets") was filed by Six Trees Capital Llc on Apr 16, 2020.

What is this patent about?

’090 is related to the field of financial management, specifically the automated optimization of financial assets across multiple online accounts. The background involves the challenge of maximizing interest returns and deposit insurance coverage when managing various accounts with differing interest rates and insurance limits. Account holders face the difficulty of manually monitoring, planning, and executing transfers to achieve optimal asset allocation.

The underlying idea behind ’090 is to create a financial management network that automatically allocates and transfers funds between a checking account and multiple savings accounts to optimize interest earned while respecting constraints like FDIC insurance limits. This is achieved without continuous user intervention by having the savings accounts initiate transfers to and from the checking account.

The claims of ’090 focus on a method performed by a third-party entity to securely access an online account protected by multi-factor authentication . This involves collecting and encrypting the account holder's credentials, verifying them by accessing the online account, receiving a multi-factor authentication request, prompting the account holder for a response, and transmitting that response to satisfy the authentication request.

In practice, the system works by first determining the optimal allocation of funds across the accounts based on interest rates and user-defined rules. Then, it instructs the savings accounts to initiate transfers to the checking account, followed by transfers from the checking account back to the savings accounts, achieving the desired allocation. The system uses a two-step transfer process to avoid fees and limitations associated with checking account transfers.

This approach differs from prior art cash sweep systems that primarily focus on maximizing FDIC insurance coverage without necessarily optimizing interest yield. Unlike brokered deposit systems, the user's accounts are conventional deposit accounts held directly in their name, and the banks do not pay a fee to receive funds. This allows for higher interest rates and more favorable regulatory treatment. Furthermore, the user retains direct access to their funds without needing to coordinate with a third party.

How does this patent fit in bigger picture?

Technical landscape at the time

In the early 2010s when ’090 was filed, financial institutions commonly relied on batch electronic transfers such as Automated Clearing House (ACH) transfers or wire transfers such as FedWire transfers. At a time when interest rates may be subject to frequent and/or unpredictable fluctuations among various financial institutions, account holders had to continuously monitor, plan, and/or effect transfers of financial assets among their various accounts in order to gain the maximum benefit of interest rates offered across different financial accounts at a given time.

Novelty and Inventive Step

The examiner allowed the claims because the invention is a method for automatically adjusting the distribution of financial assets among multiple accounts in economies and financial institutions. The method involves a financial management network that monitors changed conditions pertaining to accounts and uses a credential data store to access multiple accounts over a data network. This facilitates a two-step redistribution of financial assets based on optimization rules and changed conditions, using ACH credit push and debit pull instructions. The examiner also determined that the claims qualify as patent-eligible subject matter and are not taught by the prior art of record.

Claims

This patent contains 10 claims, of which claims 1 and 6 are independent. The independent claims are directed to methods for a third party to securely access an online account secured by multi-factor authentication. The dependent claims generally add detail to the method steps recited in the independent claims.

Key Claim Terms New

Definitions of key terms used in the patent claims.

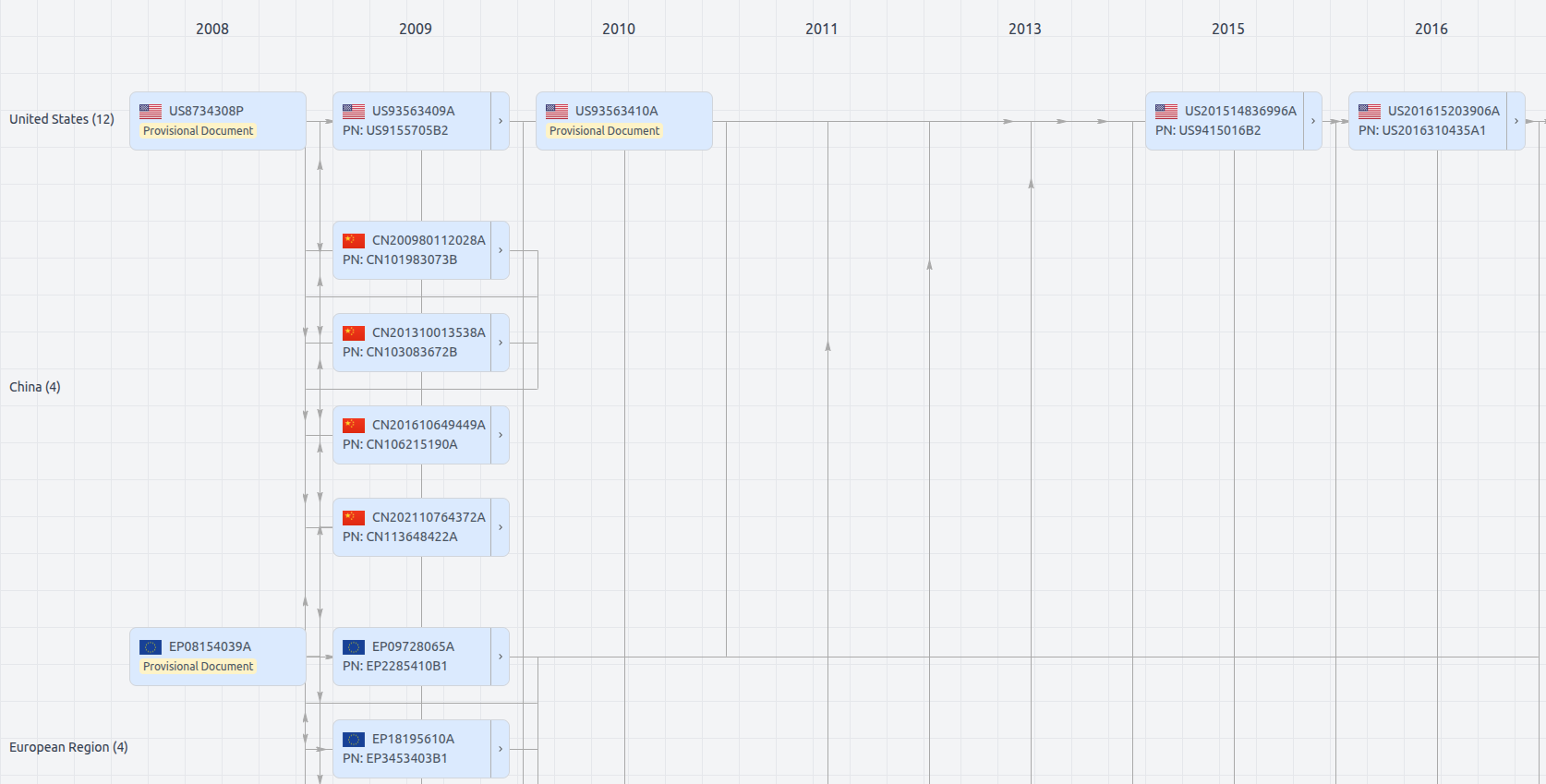

Patent Family

File Wrapper

The dossier documents provide a comprehensive record of the patent's prosecution history - including filings, correspondence, and decisions made by patent offices - and are crucial for understanding the patent's legal journey and any challenges it may have faced during examination.

Date

Description

Get instant alerts for new documents

US11315090

- Application Number

- US16850150

- Filing Date

- Apr 16, 2020

- Status

- Granted

- Expiry Date

- Jan 27, 2035

- External Links

- Slate, USPTO, Google Patents