System And Method For Card Control

Patent No. US11556936 (titled "System And Method For Card Control") was filed by Wells Fargo Bank Na on Apr 25, 2017.

What is this patent about?

’936 is related to the field of payment card fraud prevention . Specifically, it concerns systems and methods for controlling payment card usage by leveraging user demographics, transaction history, and location data to proactively identify and prevent unauthorized transactions. The background acknowledges the increasing prevalence of payment card fraud and the limitations of existing fraud prevention mechanisms.

The underlying idea behind ’936 is to create a dynamic card control system that automatically generates and enforces card control rules based on a user's profile and behavior, as well as the behavior of similar users. This system allows users to customize these rules through a card control dashboard, providing them with greater control over their payment card usage and reducing the risk of fraudulent transactions. The system also uses location data to proactively alert users of potential restrictions.

The claims of ’936 focus on a card control computing system that receives demographic and transaction history data from electronic databases for both a user and a set of other users. The system analyzes this data to identify a subset of similar users and their card control rules. Based on this analysis, the system selects and proposes card control rules for the user's payment card. The system also generates new rules when it identifies out-of-pattern transactions. The user can then activate these rules through a card control dashboard. The system enforces these rules by analyzing transactions, receiving location data from the user's device, and denying transactions that violate the activated rules.

In practice, the system uses clustering analysis to group users with similar spending habits and demographics. This allows the system to identify unusual transaction patterns and proactively suggest card control rules to prevent fraud. For example, if a user attempts to make a purchase at a merchant that is rarely patronized by similar users, the system can generate a card control rule to restrict that transaction. The system also uses the user's location data to provide real-time alerts and prevent transactions at restricted locations.

This approach differs from traditional fraud prevention methods by being proactive and personalized. Instead of relying on after-the-fact detection, ’936 anticipates potential fraudulent activity based on user behavior and location. The card control dashboard empowers users to customize their card control rules, providing a more convenient and user-friendly experience compared to existing fraud prevention mechanisms that often require card cancellation and re-issuance. The use of location data adds an extra layer of security by alerting users to potential restrictions before they even attempt a transaction.

How does this patent fit in bigger picture?

Technical landscape at the time

In the late 2010s when ’936 was filed, at a time when payment card fraud was a growing concern, systems commonly relied on centralized databases and rule-based engines for fraud detection. At that time, user interfaces for managing financial accounts were becoming increasingly sophisticated, with mobile applications and web-based dashboards being widely adopted. Furthermore, location-based services were becoming more prevalent, allowing for the integration of geographic data into transaction authorization processes.

Novelty and Inventive Step

The examiner allowed the claims because the prior art, including Kirsch, Poole, Salama, and Shrivastava, failed to disclose the specific combination of elements recited in the claims. Specifically, the prior art did not teach using demographic and transaction histories of a user and other users to select a first transaction rule specific to a merchant while also generating a second rule in response to a potential fraudulent transaction. Additionally, Shrivastava failed to teach receiving an indication of a transaction, generating a second rule based on the attempted transaction being determined to be an out-of-pattern transaction as a result of querying a database storing previous transaction histories of other users, and enforcing the rules by at least receiving a GPS location of a user device relative to the merchant to determine if the transaction violates the rules generated.

Claims

This patent includes 18 claims, with claims 1 and 10 being independent. The independent claims focus on a card control computing system and a method for controlling payment card transactions based on analysis of user demographic information and transaction histories, and comparison to other users. The dependent claims generally elaborate on and refine the features and functionalities described in the independent claims.

Key Claim Terms New

Definitions of key terms used in the patent claims.

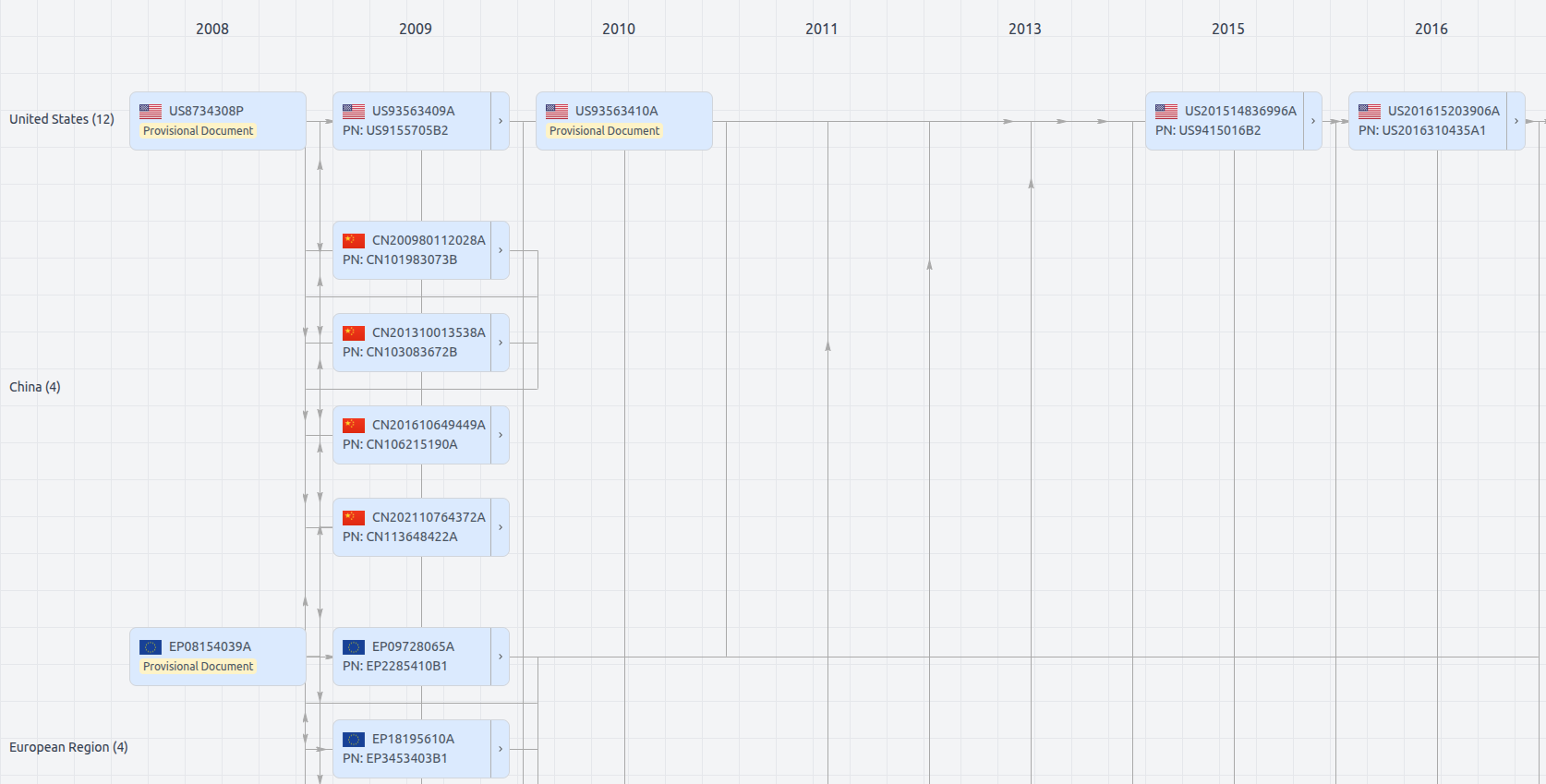

Patent Family

File Wrapper

The dossier documents provide a comprehensive record of the patent's prosecution history - including filings, correspondence, and decisions made by patent offices - and are crucial for understanding the patent's legal journey and any challenges it may have faced during examination.

Date

Description

Get instant alerts for new documents

US11556936

- Application Number

- US15496961

- Filing Date

- Apr 25, 2017

- Status

- Granted

- Expiry Date

- Nov 17, 2038

- External Links

- Slate, USPTO, Google Patents