Method And System For Mobile Banking Using A Server

Patent No. US11847649 (titled "Method And System For Mobile Banking Using A Server") was filed by Blaze Mobile Technologies Llc on Apr 20, 2015.

What is this patent about?

’649 is related to the field of data communications and wireless devices, specifically addressing the security of mobile payment transactions conducted via mobile applications. The background acknowledges the increasing use of mobile devices for financial transactions and the critical need to protect users from fraud resulting from device loss or theft. Traditional methods often lack robust security measures, leaving sensitive data vulnerable.

The underlying idea behind ’649 is to enhance the security of mobile banking transactions by using a server-managed mobile application that minimizes the storage of sensitive data on the mobile device itself. The mobile application is hosted and operated through a server, allowing for centralized monitoring and management of security aspects. This approach aims to reduce the risk of data exposure in case of device loss or theft.

The claims of ’649 focus on a method, system, and non-transitory computer readable medium for conducting a mobile banking transaction using a server. The claims cover receiving user input login information from a non-browser based application (a downloaded and installed mobile app) on a mobile device, authenticating the user at the server, receiving a mobile banking transaction request from the app, processing the transaction at the server using a payment method corresponding to the user's identification code, and sending a digital artifact back to the app.

In practice, the invention involves a user logging into a mobile banking application on their phone. The application, instead of directly storing sensitive information, communicates with a remote server. The server authenticates the user and processes the transaction using stored payment methods. After the transaction, the server sends a digital receipt or confirmation back to the application. This architecture ensures that sensitive data, like credit card numbers, are primarily stored on the server, reducing the risk if the phone is compromised.

This approach differentiates itself from prior solutions by centralizing the security management on the server-side. Features like session keys , which are invalidated after a period of inactivity or upon a remote lock command, add an extra layer of security. Furthermore, the option to set a payment limit PIN and the potential use of biometric authentication provide additional control and protection against unauthorized transactions. By minimizing local storage of sensitive data and implementing server-side security measures, the invention aims to provide a more secure mobile banking experience.

How does this patent fit in bigger picture?

Technical landscape at the time

In the late 2000s when ’649 was filed, mobile devices were increasingly used for payment transactions, at a time when security was a primary concern. Systems commonly relied on PINs and other authentication methods to protect sensitive data on these devices. Hardware or software constraints made secure communication and application management on mobile devices non-trivial.

Novelty and Inventive Step

The examiner approved the application because the allowed claims were deemed patentable under 35 U.S.C. 101, satisfying the 2019 Revised Patent Subject Matter Eligibility Guidance. The examiner determined that the allowed claims were non-obvious over the cited prior art references, specifically USPGPub No. US 20010056402 A1, USPGPub No. US 20030210127 A1, and USPGPub No. US 20040267665 A1, pursuant to the Patent Trial and Appeal Board's Decision rendered March 9, 2023.

Claims

This patent contains 23 claims, with independent claims 1, 12, and 23. The independent claims are generally directed to a method, system, and non-transitory computer readable medium for conducting a mobile banking transaction using a server and a non-browser based application on a mobile device. The dependent claims generally elaborate on the specifics of the mobile banking transaction, the digital artifact, user input login information, network connectivity, data storage, application behavior, and server configuration.

Key Claim Terms New

Definitions of key terms used in the patent claims.

Litigation Cases New

US Latest litigation cases involving this patent.

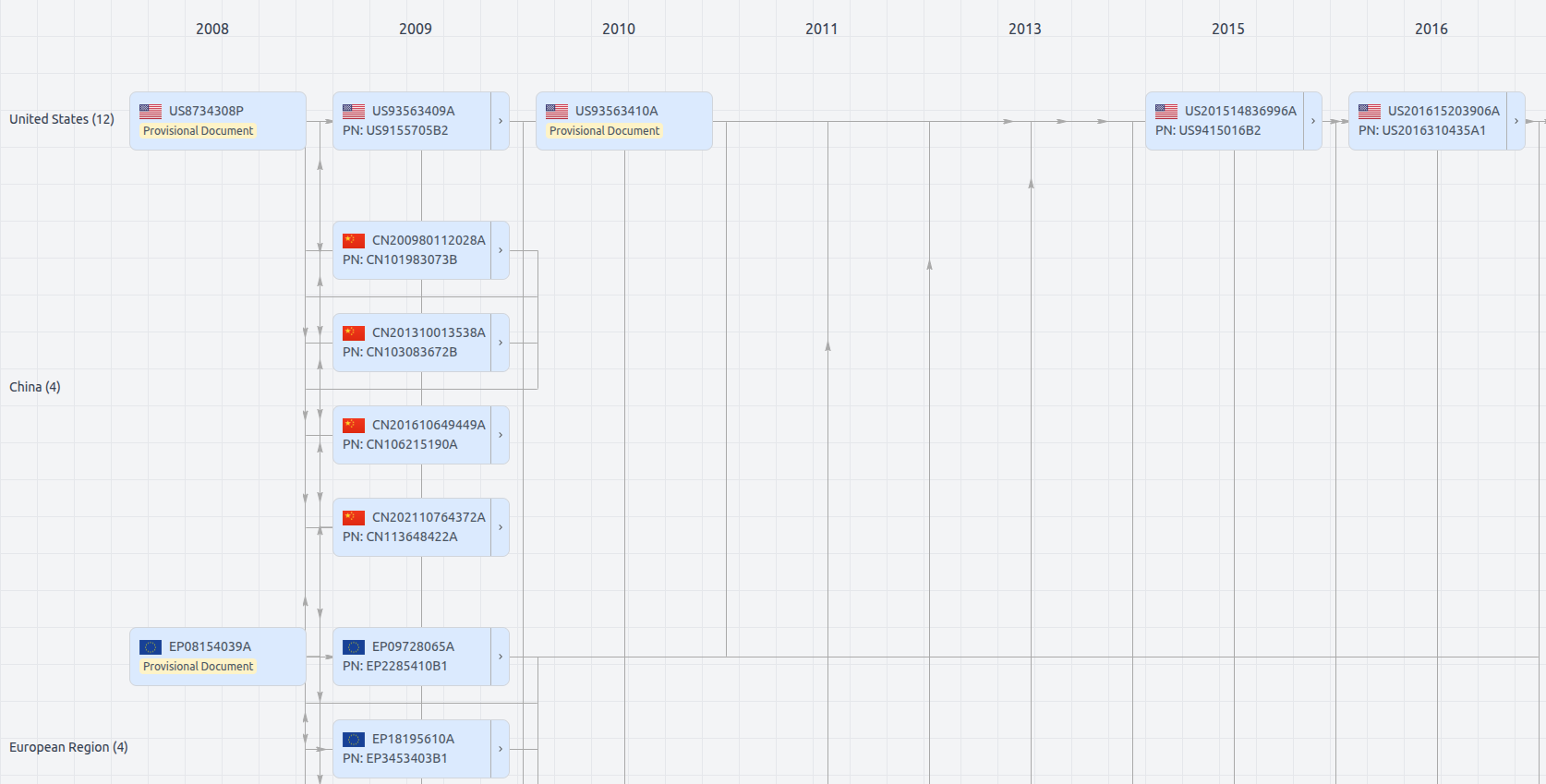

Patent Family

File Wrapper

The dossier documents provide a comprehensive record of the patent's prosecution history - including filings, correspondence, and decisions made by patent offices - and are crucial for understanding the patent's legal journey and any challenges it may have faced during examination.

Date

Description

Get instant alerts for new documents

US11847649

- Application Number

- US14691537

- Filing Date

- Apr 20, 2015

- Status

- Granted

- Expiry Date

- Feb 16, 2032

- External Links

- Slate, USPTO, Google Patents